Whether you are managing a small business’s finances or overseeing a multinational corporation’s financial records, maintaining data consistency is crucial. This article dives into the significance of accuracy in accounting systems and explores various strategies to ensure data consistency.

The Importance of Data Consistency

Consistency in accounting systems refers to the reliability and uniformity of financial information. It means that the numbers and figures used for decision-making and financial reporting are accurate, reliable, and consistent across all records and transactions. The following points illustrate why consistency of data is of utmost importance in accounting:

Informed Decision-Making: Accurate financial data is the foundation upon which sound business decisions are made. Inaccurate or inconsistent data can lead to poor decision-making, potentially resulting in financial losses or loss opportunities.

Regulatory Compliance: Many industries and businesses are subject to strict regulations and reporting requirements. Maintaining data consistency ensures compliance with these regulations, reducing the risk of fines, penalties, and legal consequences.

Investor Confidence: Investors and stakeholders rely on financial reports to assess a company’s performance and stability. Inaccurate data erodes investor confidence, potentially impacting a company’s ability to attract investment for required growth.

Internal Control: Accurate data is essential for internal controls and audits. It helps prevent fraud, errors, and unauthorized access to financial information.

Financial Transparency: Businesses that maintain consistent data among the different subsystems demonstrate a commitment to transparency, which fosters trust among customers, suppliers, and partners.

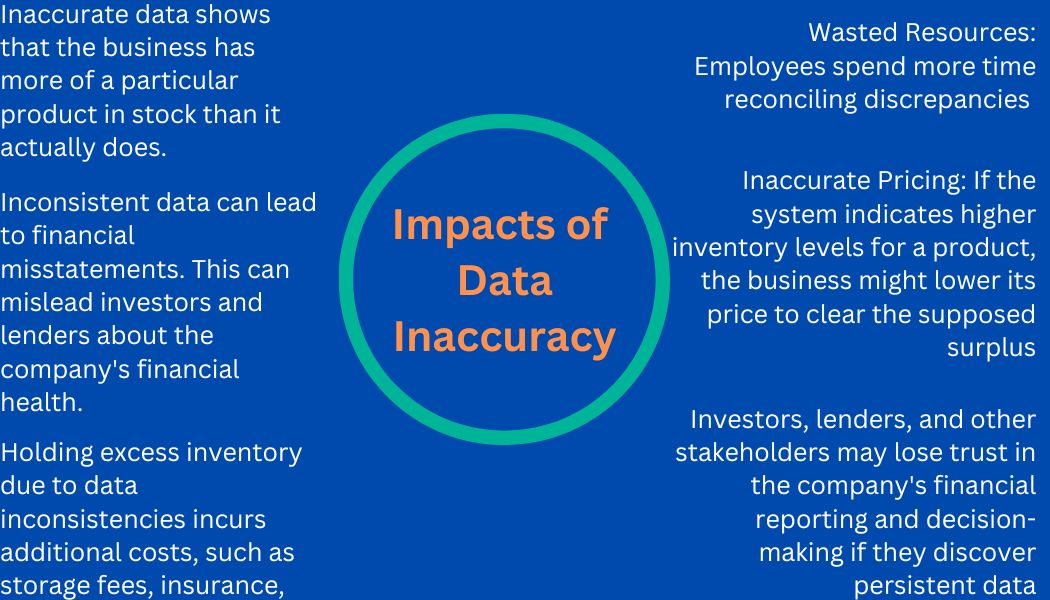

Impacts of data Inconsistency

Strategies for Ensuring Data Accuracy and Consistency

Now that we understand the importance of data consistency let’s explore some strategies for achieving and maintaining accuracy in accounting systems:

Standardized Processes: Establish standardized accounting procedures and processes within your organization. This includes consistent chart of accounts, categorization of expenses, and reconciliation protocols.

Automation: Embrace accounting software and automation tools to reduce manual data entry errors. These systems can streamline data entry, reduce human error, and improve overall efficiency.

System Integration: Accounting and financing information comes from different systems. Integration of these systems with the ERP or accounting system eliminates manual transcript errors and ensures accuracy.

Regular Reconciliation: Conduct regular reconciliations of financial statements, bank accounts, and other critical accounts. Reconciliation ensures that the data in your records matches external sources.

Data Security: Protect financial data with robust security measures. Unauthorized access or data breaches can lead to data inconsistencies and potential financial losses.

Third-Party Audits: Consider engaging third-party auditors to review and analyze your financial records periodically. Independent audits reassure data consistency. Independent analysis of financial information provides an additional layer of consistency by detecting misinterpretations of the information.

Data Documentation: Maintain detailed documentation of financial transactions and adjustments. This documentation helps track changes and ensures accountability.

Regular Reviews: Implement a review process where senior staff or managers periodically review financial records for accuracy and consistency.

Conclusion

Data consistency and accuracy are non-negotiable. Ensuring the reliability of financial data is essential for making informed decisions, maintaining regulatory compliance, and building trust with stakeholders. Promoting USA specialized administrative includes auditing and financial analysis that result in standardized processes, consistency of data and advanced financial analysis. If you want to learn more, give us your information to schedule a meeting.

I hope this article has been helpful. I will continue to post information related to trade channel management, general economy and market trends. If you are interested in this article or want to learn more about Promoting USA, please subscribe to stay updated on future articles.