To make informed financial decisions you need accurate financial reporting. From all the processes involved in generating financial information, account reconciliation stands out as the one ensuring the integrity of financial records. In this article, I explore how mastering account reconciliation, its importance, challenges, and actionable insights to achieve precise financial reporting.

Scope of Account Reconciliation

Account reconciliation is the key process in harmonizing financial records from various sources to ensure consistency. Traditionally, account reconciliation is associated with financial accounts like bank, credit cards, AR or AP. However, mastering account reconciliation extends to complex domains like:

- Reconciling sales and invoices from Direct Store Delivery (DSD) devices and accounting systems.

- Inventory reconciliations between Warehouse Management Systems (WMS) and accounting platforms.

By mastering account reconciliation within this context, you can detect discrepancies, correct errors, and maintain coherent financial records.

Importance of Accurate Financial Reporting

Accurate financial reporting is the bedrock upon which businesses build trust and make informed decisions. Below are some of the benefits associates to a sound account reconciliation.

Transparency: Transparent reporting provides a clear snapshot of an organization’s financial health, fostering trust among investors and partners.

Tax Optimization: By leveraging accurate financial data, businesses can strategically manage their tax obligations and optimize profits.

Error Detection and Accountability: Accurate financial reports enable accountability and helps identify errors, irregularities, or potential fraud, maintaining the integrity of financial records.

Trust Building: Inaccurate financial reporting erodes trust and tarnishes reputations.

Enhanced Forecasting: Detailed financial reporting facilitates accurate forecasting of future trends, allowing businesses to prepare for potential challenges and seize emerging opportunities.

Challenges in Mastering Account Reconciliation

Mastering account reconciliation has several challenges. Inconsistent data entry, timing disparities, and human inaccuracies can lead to discrepancies that could compromise the accuracy of financial information. The reconciliation process involves extracting pertinent data from disparate sources, such as DSD devices, banks, and accounting systems, and comparing them for alignment. When reconciling sales with invoices, and inventory from WMS and accounting, meticulous attention is required to spot discrepancies that might affect financial reporting accuracy.

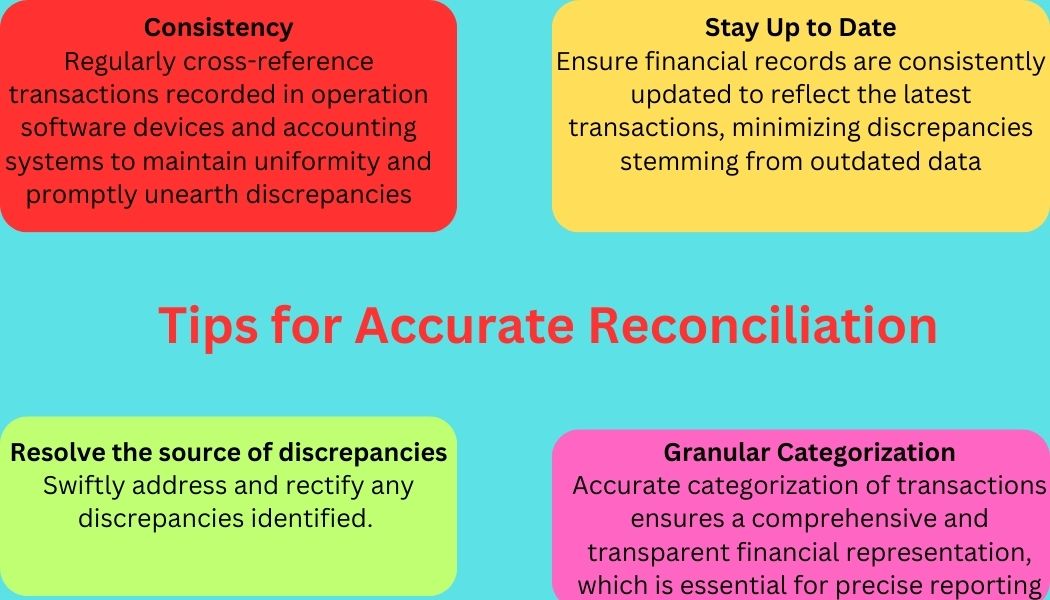

Tips for Accurate Reconciliation

Best Practices in Account Reconciliation: Where Automation and Excellence Converge

Mastering account reconciliation isn’t solely about balancing numbers; it’s about embracing best practices that pave the way for accurate financial reporting. In this section, I list some of the recommended practices.

Automation and Digital Transformation: Embrace the digital wave. Incorporate reconciliation software and operational tools that automate data synchronization between platforms, reducing errors and enhancing efficiency.

Strategic Alignment with KPIs: Align your account reconciliation efforts with Key Performance Indicators (KPIs). Each reconciled number should feed into your organization’s larger strategic goals, ensuring that financial reporting resonates with your overall business trajectory.

Continuous Improvement Culture: Infuse continuous improvement into your reconciliation process. Regularly assess workflows, tools, and methodologies to identify areas for enhancement.

Data Quality Assurance: Implement data validation checks and standardized recording practices to ensure the foundation of your reconciliation is solid.

Collaborative Cross-Verification: Implement a collaborative approach to verification. Different team members cross-verify each other’s reconciliations, reducing the likelihood of overlooking errors and fostering a culture of accountability.

Invest in Training: Regular training ensures that your reconciliation professionals are well-versed in the latest practices and software, contributing to efficiency and accuracy.

Empowering Your Account Reconciliation with Promoting USA

Promoting USA stands as your strategic ally in mastering account reconciliation. Our comprehensive suite of services is designed to enhance your financial accuracy, streamline your processes, and align your reconciliation efforts with best practices. If you want to learn more about how we can help you with big retailers, give us your information to schedule a meeting.

I will continue to post information related to trade channel management, general economy and market trends. If you are interested in this article or want to learn more about Promoting USA, please subscribe to stay updated on future articles.

Subscribe to Promoting USA blog