Efficient management of accounts receivable is crucial for the success of any business, and most companies prefer handling them with their own resources. However, the accounts receivable management of big retailers and corporate accounts is so intricate that many companies are resorting to outsourcing account receivables of their complex customers. In this article, I go over the account receivable process focusing on big retail chains and explore the benefits of outsourcing this critical function.

Account Receivable Process

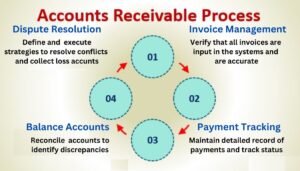

The account receivable process is simple, as illustrated in the figure below.

However, in the case of big retail chains, the account receivable process becomes more intricate due to the vast number of daily transactions, multiple locations under the corporate umbrella, and a plethora of prices and discounts. Additionally, reconciling payments, managing credit, and handling customer inquiries require dedicated resources and specialized expertise.

Challenges of Account Receivable Management for Distributors with Big Retail Customers

Distributors, especially those engaged in direct store delivery (DSD), face unique challenges when it comes to managing accounts receivable (AR) for their big retail customers. These challenges stem from the specific dynamics of their relationships with retailers and the intricacies of the distribution process. Understanding and addressing these challenges is crucial for distributors to maintain financial stability, optimize cash flow, and foster strong partnerships with their retail customers. Here are some key challenges that distributors face in AR management for big retail customers:

Account receivables portal management: Retailers with a large number of stores manage the receivables through portals. These portals vary from one retailer to another and demand specialized knowledge from the distributor, as explained in Understanding the process of selling in big retail chains.

Two-Tier invoice level: Retailers with multiple stores require invoice and payment tracking at two levels: per store and corporate. This fact complicates the account balancing.

Credits incorrectly applied: Sometimes headquarter office applies credits corresponding to one store to a different store. At a corporate level there are no discrepancies, but for distributors this will cause a discrepancy at the store level that requires special processes to reconcile.

Discount application: Distributors have many types of discounts offered to retailers. The problem is that many corporate offices of big retailers reserve the right to apply discounts out of invoices issued at the store level. In these cases, discrepancies analysis stemming from discount differences or different price lists is very complex and requires deep knowledge of the retailer portal and the claim process. For example, Sodano’s claims are by email and telephone, whereas Winn-Dixie’s are through a specific portal.

Logistic outsourcing: Small and medium distributors outsource the delivery of distant stores with logistic service providers. In many cases the delivery is made with printed invoices, which must be input manually by the receiver. Tracking invoice differences in these cases is cumbersome and time consuming.

4 reasons why outsourcing account receivables of big retailers

Expertise and Efficiency: Outsourcing account receivables to specialized service providers grants access to professionals with extensive experience and knowledge in managing these complex accounts.

Cost Savings: Managing the AR process of these retailers requires significant investments in staff, technology, and infrastructure. Outsourcing account receivables eliminates these costs, as service providers operate with their resources and systems.

Lost accounts recovery: By knowing how to download data from portals and how to analyze and process claims, specialized administrative companies can recover a high percentage of lost account receivables. As a reference, for one of the companies that retained our services to manage the complex AR, we recovered 100% of the pending receivables from 2 years, amounting to more than a hundred thousand dollars.

Stop the AR bleeding: Recovering loss receivables is a deal of accomplishment, but the main benefit of outsourcing account receivables is to stop invoices left unpaid through constant and careful analysis of the data downloaded from the portals.

If you want to learn more about how we can help you streamline your account receivables give us your information to schedule a meeting.

I hope this article on outsourcing account receivables has been helpful to you. I will continue to post information related to trade channel management, general economy and market trends. If you are interested in this article or want to learn more about Promoting USA, please subscribe to stay updated on future articles.

Subscribe to Promoting USA blog