For any business owner in the US, payroll is a critical but often complex function. Ensuring accurate and timely employee payments while staying compliant with a labyrinth of federal, state, and local regulations can feel overwhelming. This article explores key aspects of payroll and payroll reporting, emphasizing compliance and efficiency in the US.

Understanding Payroll Basics

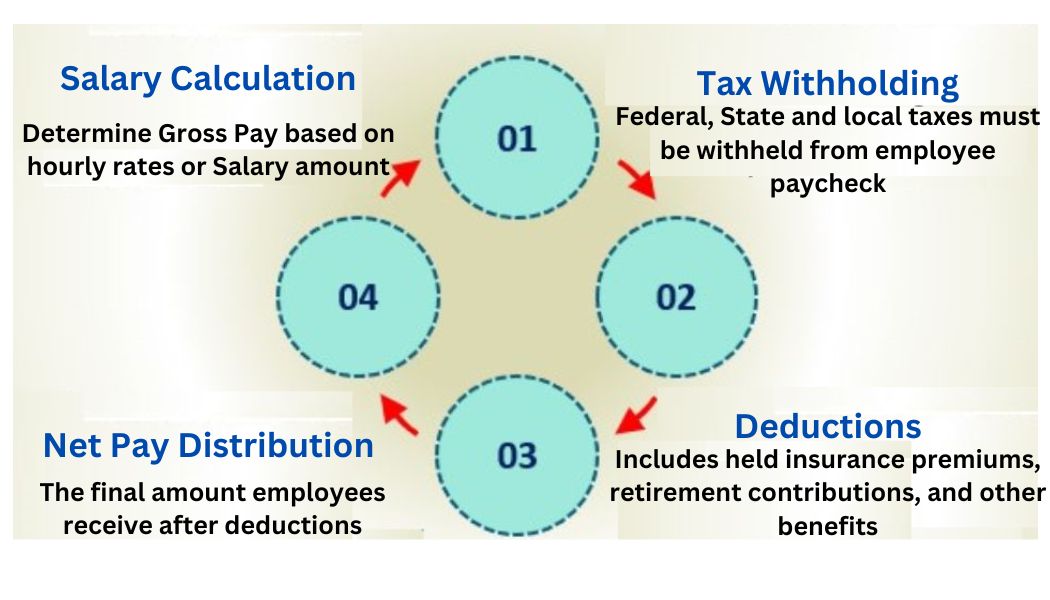

Payroll refers to the process by which employers compensate employees for their work. It involves calculating wages, withholding taxes, and distributing paychecks. Payroll processing includes:

Payroll reporting to Comply with Payroll Regulations

Compliance is paramount in payroll management. US businesses must adhere to numerous federal, state, and local regulations to avoid penalties and legal issues.

Key Federal Regulations

- Fair Labor Standards Act (FLSA): Governs minimum wage, overtime pay, and recordkeeping requirements.

- Federal Insurance Contributions Act (FICA): Mandates payroll taxes for Social Security and Medicare.

- Federal Unemployment Tax Act (FUTA): Imposes a payroll tax to fund unemployment compensation.

- Affordable Care Act (ACA): Requires employers to provide health insurance to eligible employees and report coverage information.

- Equal Pay Act (EPA): The EPA prohibits gender-based wage discrimination.

State and Local Regulations

State and local governments may impose additional requirements, such as state income tax withholdings, unemployment insurance, and workers’ compensation. Businesses must stay informed about specific regulations in each state where they operate.

Efficiency: Streamlining Your Payroll Process

While compliance is paramount, efficiency is crucial for saving time and resources. Here’s how to streamline your payroll:

Embrace Payroll Technology: Invest in payroll software that automates calculations, deductions, and filings. This minimizes errors and frees up your time.

Accurate Time Tracking: Implement a reliable system for employees to track their hours. This ensures proper pay for both regular and overtime work.

Data Security: Safeguard sensitive employee information with robust data security measures like encryption and access controls.

Regular Reviews and Audits: Conduct periodic reviews of your payroll processes to identify and rectify any discrepancies.

Payroll Reporting: Keeping Your Records in Order

Maintaining accurate and complete payroll records is essential for compliance and audits. These records should include:

- Employee demographics and tax information

- Time worked and wages earned

- Deductions and withholding

- Tax payments made

Seeking Help: When to Consider Outsourcing

Payroll complexities can be challenging, especially for small businesses. Consider outsourcing payroll processing to a reputable provider. This can alleviate the burden of compliance and free up your resources to focus on core business activities.

Conclusion

Navigating payroll and payroll reporting in the US requires a careful balance of compliance and efficiency. By understanding key regulations, implementing efficient processes, and adhering to best practices, businesses can manage payroll effectively, minimize risks, and ensure employee satisfaction. Promoting USA provides consulting on payroll management as part of its Specialized Administration Services. If you have any specific areas you would like to explore further or any questions, give us your information so we can schedule a meeting.

I hope this article about payroll reporting and management has been helpful. I will continue to post information related to trade channel management, general economy and market trends. If you are interested in this article or want to learn more about Promoting USA, please subscribe to stay updated on future articles.