Sales tax compliance and reporting are a must for running a successful and legally compliant business. With varying tax rates, regulations, and requirements across different states and jurisdictions, staying on top of sales tax can seem like a never-ending challenge. In this article, I will demystify sales tax by exploring the basics of compliance and reporting, helping businesses navigate this intricate landscape.

Understanding Sales Tax

Sales tax is a consumption tax imposed by state and local governments on the sale of goods and services. Unlike income tax, which individuals pay on their earnings, sales tax is collected by businesses at the point of purchase and then remitted to the appropriate taxing authorities. The tax rate and rules can vary significantly from one location to another, making it essential for businesses to understand the specific requirements of the areas where they operate.

Determining Nexus

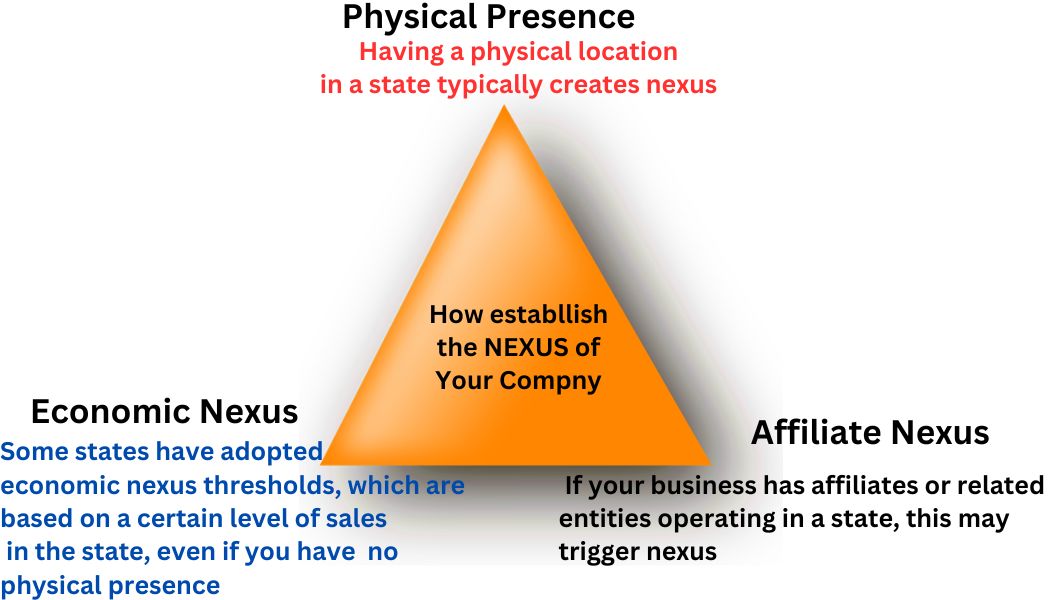

One of the first steps in sales tax compliance is determining your business’s nexus. Nexus is a legal term that refers to the level of connection or presence your business has in a particular state or jurisdiction. If your business has a substantial presence in a state, you are generally required to collect and remit sales tax on transactions within that state.

Nexus can be established in several ways, including:

Collecting Sales Tax

Once you have determined that your business has nexus in a particular state, you must collect sales tax from your customers on taxable transactions. Taxable transactions can include sale of physical goods, digital products, and certain services, depending on the state’s tax laws.

To collect sales tax, you’ll need to:

- Register for a Sales Tax Permit: In most cases, you’ll need to register for a sales tax permit with the state’s taxing authority. This typically involves completing an application and providing information about your business.

- Determine the Appropriate Tax Rate: Different products and services may be subject to varying tax rates within the same state. It’s crucial to identify the correct tax rate for each transaction.

- Include Tax on Invoices: Clearly indicate the sales tax amount on customer invoices or receipts.

- Keep Accurate Records: Maintain detailed records of all sales and tax collected to facilitate reporting and auditing.

Reporting and Remitting Sales Tax

Sales tax reporting involves documenting all the sales tax you have collected from customers during a specific reporting period. The reporting frequency and deadlines vary by state, but most states require businesses to file on a monthly, quarterly, or annual basis. It is essential to meet these deadlines to avoid penalties and interest charges.

When reporting and remitting sales tax, follow these steps:

Calculate Total Sales Tax Collected: Add up the sales tax you collected on taxable transactions during the reporting period.

Complete the Sales Tax Return: Fill out the appropriate sales tax return provided by the state’s taxing authority. This form will require you to report total sales, exempt sales, and taxable sales.

Pay the Sales Tax Owed: If you collected more in sales tax than you owe, you need to remit the excess to the state. Conversely, if you collected less than what you owe, you need to pay the difference.

File on Time: Ensure you file the sales tax return and remit the tax on or before the specified due date.

Sales Tax Automation

For many businesses, managing manually sales tax compliance can be time-consuming and prone to errors. To streamline the process, consider using sales tax automation software or services. These tools can help calculate the correct tax rate, track tax collection, and generate accurate reports.

Conclusion

Sales tax compliance and reporting may seem complex. It is crucial to understand your nexus, collect sales tax correctly, and file accurate reports in a timely manner to avoid potential fines and penalties. Staying up-to-date with changing tax laws and seeking professional guidance when necessary will help ensure your business remains compliant and financially secure. Sales tax compliance and reporting are part of Promoting USA specialized administrative services. If you want to learn more, give us your information to schedule a meeting.

I hope this article about sales tax compliance has been helpful. I will continue to post information related to trade channel management, general economy and market trends. If you are interested in this article or want to learn more about Promoting USA, please subscribe to stay updated on future articles.