Chapter 11 of the United States Bankruptcy Code is a significant legal framework that allows financially distressed businesses to reorganize and potentially emerge from bankruptcy as a stronger and more financially stable entity. In this article, I explore the crucial role accounting plays in Chapter 11 bankruptcy proceedings and how it helps both debtors and creditors understand and manage the complexities of the process.

The Basics of Chapter 11 Bankruptcy

Chapter 11 bankruptcy is primarily designed for businesses, including corporations, partnerships, and limited liability companies, which are unable to meet their financial obligations but wish to continue their operations. Unlike Chapter 7 bankruptcy, which involves liquidation of assets to repay creditors, Chapter 11 focuses on the rehabilitation of the company’s financial affairs.

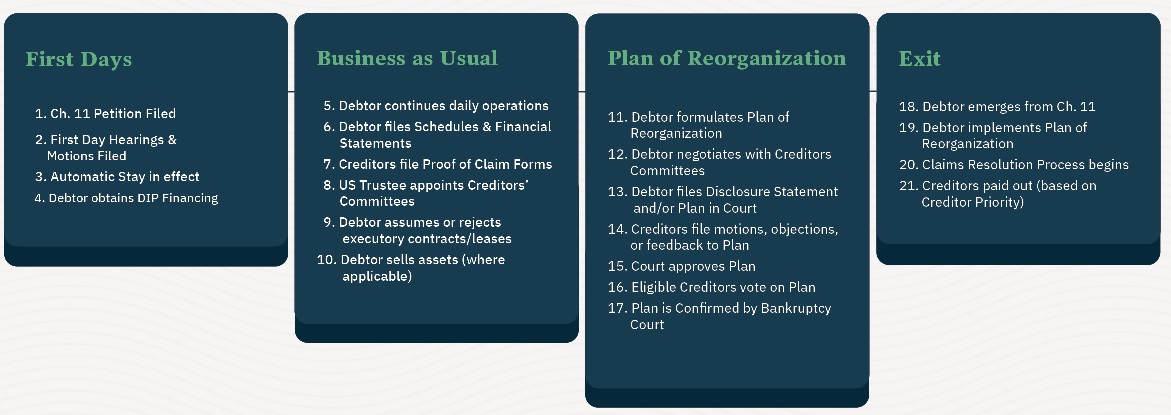

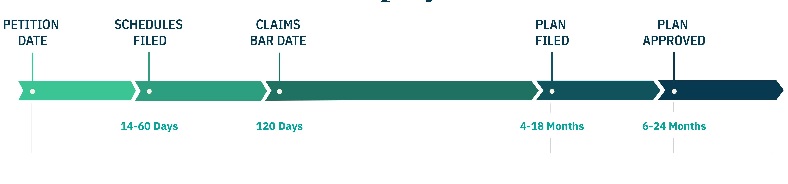

Chapter 11 Process

The chart illustrates the process associated to a Chapter 11 proceeding and its timeline.

The Role of Accounting in Chapter 11

Accounting and financial expertise are essential in a chapter 11 restructuring process. This is how.

Financial Reporting and Disclosure: One of the first steps in a Chapter 11 bankruptcy case is to prepare comprehensive financial statements. These statements include balance sheets, income statements, cash flow statements, and other relevant financial documents. Accurate and transparent financial reporting is critical for stakeholders, including creditors, investors, and the court, to assess the debtor’s financial health and the potential for recovery.

Development of the Reorganization Plan: The heart of Chapter 11 bankruptcy is the creation of a reorganization plan. This plan outlines how the company will address its debts, restructure its operations, and ultimately emerge from bankruptcy. Accountants play a pivotal role in this process by analyzing the company’s financial data, assessing the plan feasibility, and ensuring that it complies with bankruptcy laws and regulations.

Valuation of Assets and Liabilities: Accurate valuation of assets and liabilities is essential in determining the company’s financial position and the distribution of assets to creditors. The valuation involves assessing the fair market value of assets and understanding the priority of claims, which may vary depending on the type of debt (secured, unsecured, priority, etc.).

Cash Flow Projections: Developing realistic cash flow projections is vital for the success of the reorganization plan. Accountants and consultants work closely with management to create these forecasts, evaluating various scenarios and potential changes in the business environment. These projections help creditors and the court assess the debtor’s ability to meet its financial obligations during and after bankruptcy.

Compliance and Reporting: Throughout the Chapter 11 process, the debtor must ensure that it complies with accounting and reporting requirements mandated by the bankruptcy court. These requirements include preparing periodic financial reports, disclosing material changes, and maintaining accurate records.

Conclusion

Chapter 11 bankruptcy is a complex legal process that demands a deep understanding of financial matters. Expertise is critical in determining the outcome of Chapter 11 proceedings and, ideally, allowing distressed businesses to emerge from bankruptcy as viable and sustainable entities once again. Organizations like Promoting USA can help companies navigate this complicated process, from preparing financial statements and negotiating with creditors to developing reorganization plans and ensuring compliance with the law. If you want to learn more, give us your information to schedule a meeting.

I hope this article has been helpful. I will continue to post information related to trade channel management, general economy and market trends. If you are interested in this article or want to learn more about Promoting USA, please subscribe to stay updated on future articles.