Cash is the lifeblood of any organization, and an effective cash handling is crucial for securing financial stability. No matter your company size and industry type of your company, you need a way to manage your cash flow. In this article, I will explore the importance of cash management and projections in securing financial stability.

What is Cash Management?

Managing cash involves monitoring, analyzing, and optimizing the cash flows of an entity. It encompasses everything from handling daily transactions to making strategic decisions about investments and financing.

Why is important to Manage the Cash Flow

Here are some key of the benefits:

Ensures Liquidity: Proper cash management ensures that a business has enough cash on hand to meet its short-term obligations. It safeguards against situations where you might struggle to pay bills or face late payment penalties.

Supports Growth: Effective cash flow management allows capital allocation to support business growth. Having a clear picture of your cash position, you can invest in opportunities or expand your operations when the time is right.

Reduces Borrowing Costs: When you can forecast your cash needs accurately, you are less likely to rely on costly short-term loans or lines of credit to cover unexpected expenses.

Minimizes Risk: Cash management helps identify potential financial problems early on, enabling you to take corrective actions before they escalate.

Enhances Decision-Making: With accurate cash flow data, you can make informed decisions about investments, cost-cutting measures, and long-term financial strategies.

Cash Flow Projections

Cash flow projections are a critical component of cash management. They involve estimating the future cash inflows and outflows of a business or personal finances over a specific period, typically months or years. Here’s why cash flow projections are essential:

- Anticipate Shortages: By projecting your future cash position, you can identify periods when cash may be tight and plan accordingly. This allows you to arrange for additional financing or delay certain expenditures.

- Budgeting: Cash flow projections provide a basis for creating a budget, helping you allocate resources effectively and prioritize spending.

- Set Realistic Goals: Accurate projections help you set achievable financial goals, be it increasing savings, reducing debt, or expanding a business.

- Track Performance: Regularly comparing actual cash flows to projections allows you to assess the accuracy of your forecasts and make adjustments as needed.

Key Elements of Effective Cash Management

Cash Flow Forecasting: Accurate cash flow forecasting is the cornerstone of effective cash flow management. Organizations can anticipate upcoming cash inflows and outflows by analyzing historical data, current trends, and future projections, . This foresight enables them to plan for potential shortfalls, optimize investment decisions, and negotiate favorable payment terms with vendors.

Collection Management: Efficient collection of receivables is crucial for maintaining a healthy cash flow. Organizations should establish clear credit policies, implement prompt collection procedures, and leverage on technology to automate payment processing. By streamlining the collection process, they can minimize the time it takes to convert sales into cash.

Payment Management: Effective payment management ensures that organizations meet their obligations without tying up excessive cash resources. Optimizing payment schedules, negotiating favorable terms with suppliers, and utilizing electronic payment systems can streamline the disbursement of funds and reduce unnecessary cash outflows.

Investment Decisions: Surplus cash can be strategically invested to generate additional revenue and enhance long-term financial stability.

Monitoring and Reporting: Regular cash flow monitoring and financial performance is essential for identifying potential liquidity issues and taking corrective actions promptly. Organizations should establish clear reporting mechanisms to track cash balances, analyze trends, and inform decision-making.

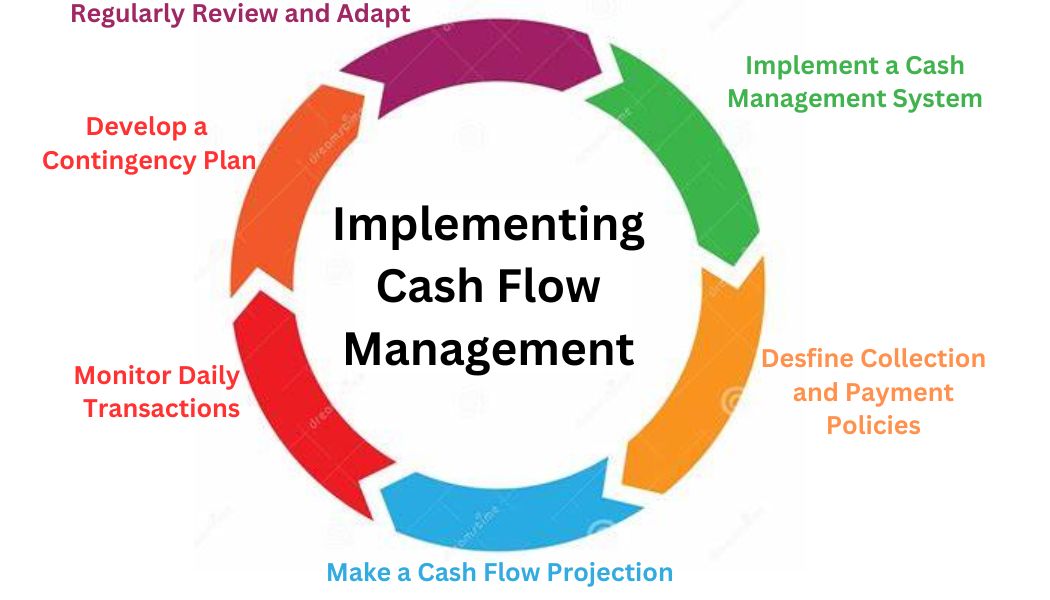

Steps to Effective Cash Flow Management

To secure financial stability through cash management and projections, follow these steps:

Promoting USA and Cash projection

Managing and projecting cash flow are indispensable tools for securing financial stability, whether in personal finance or business operations. Our Specialized Administrative Services includes process optimization, distribution logistics, and financial projections. If you want to learn more, give us your information to schedule a meeting.

I hope this article have been helpful. I will continue to post information related to trade channel management, general economy and market trends. If you are interested in this article or want to learn more about Promoting USA, please subscribe to stay updated on future articles.

Subscribe to Promoting USA blog